Payments and invoicing

Streamlined payment processing and invoicing for your influencer collaborations, without the hassle of accounting- or compliance concerns

Easy payments

Simplified Influencer payment and invoicing

linkr's payment and invoicing feature optimizes influencer collaboration pricing and simplifies transactions. The platform calculates the optimal price for each cooperation based on various factors such as the influencer's reach and engagement and then allows both parties to negotiate and agree on a fair price. After completion, brands pay the agreed sum with one click, ensuring a quick, hassle-free payment experience.

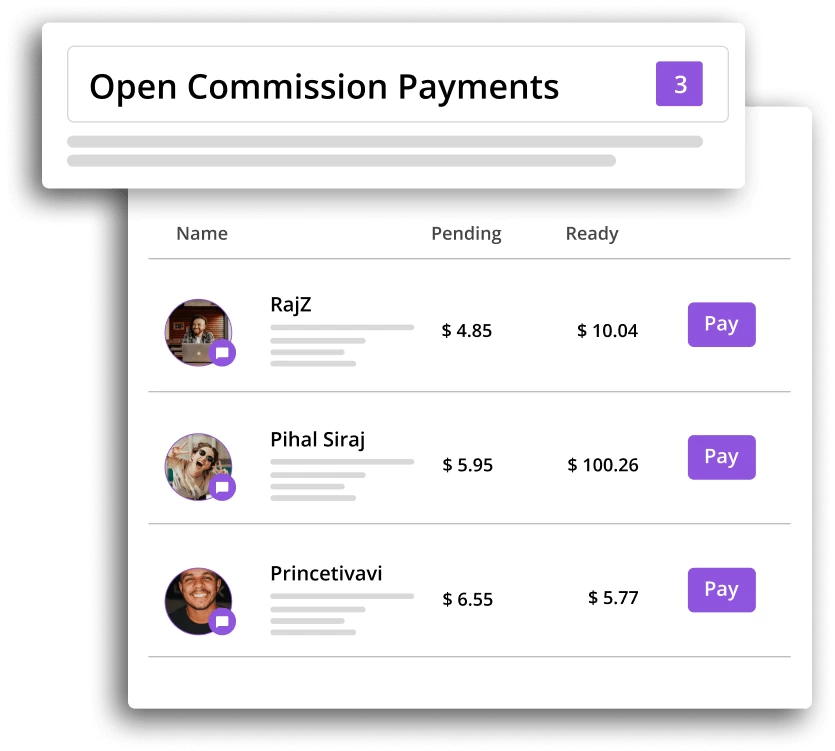

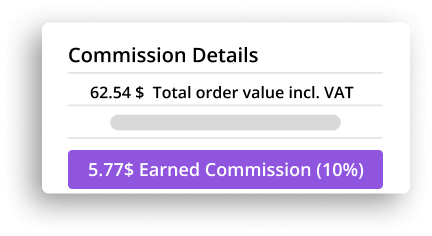

Automated commissions

Effortless sales commission payouts: Let linkr do the math for you

With the linkr platform, you don't have to worry about manually calculating sales commissions for each influencer. The platform automatically tracks and calculates commissions for every sale generated through influencer partnerships. Brands can conveniently pay out commissions to influencers with just one click, making the process seamless and hassle-free.

Say goodbye to tedious commission calculations and hello to more time to focus on growing your business.

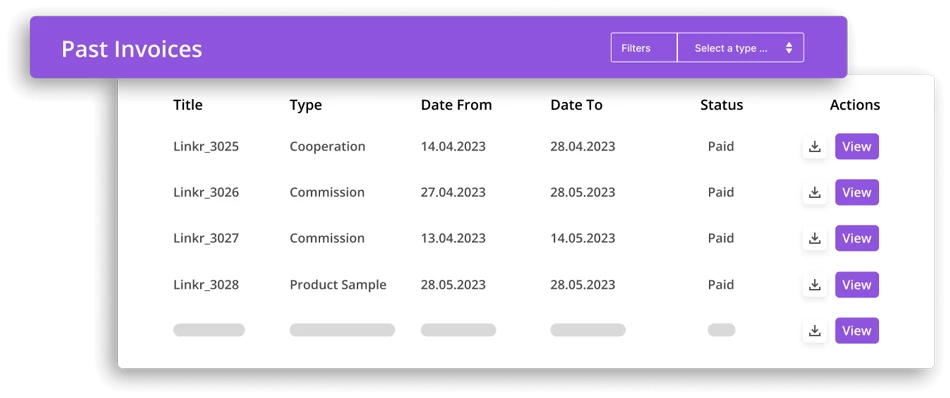

Smooth invoicing

Keep your accounting department happy with linkr's easy invoicing process

Does your accounting department already hate you for the trouble of receiving multiple invoices from numerous influencers and chasing them for correct invoices?

linkr's payment and invoicing feature gives brands the option to pay influencers in single or bulk mode. The corresponding invoices are automatically generated by the platform, ready for convenient download by brands. This streamlined process ensures smooth accounting for your business. Save time and reduce administrative work with linkr's streamlined payment and invoicing process.

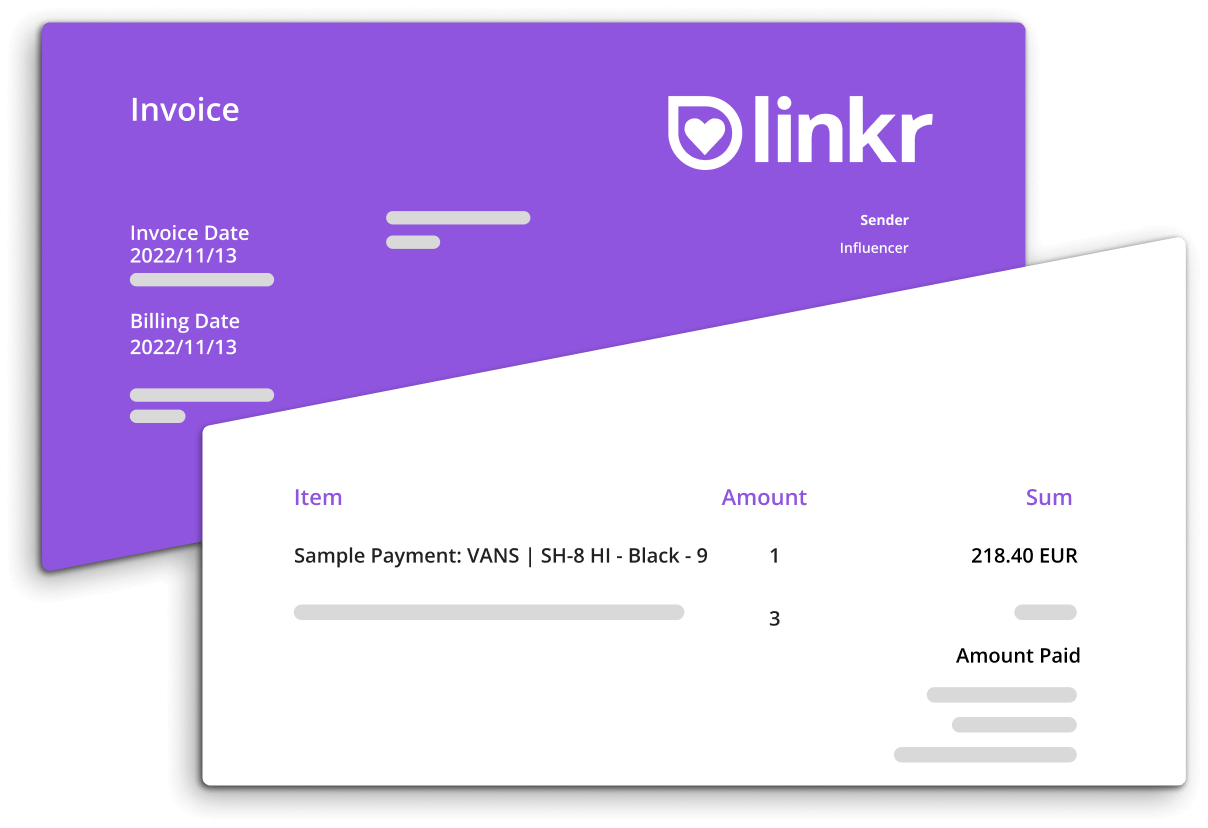

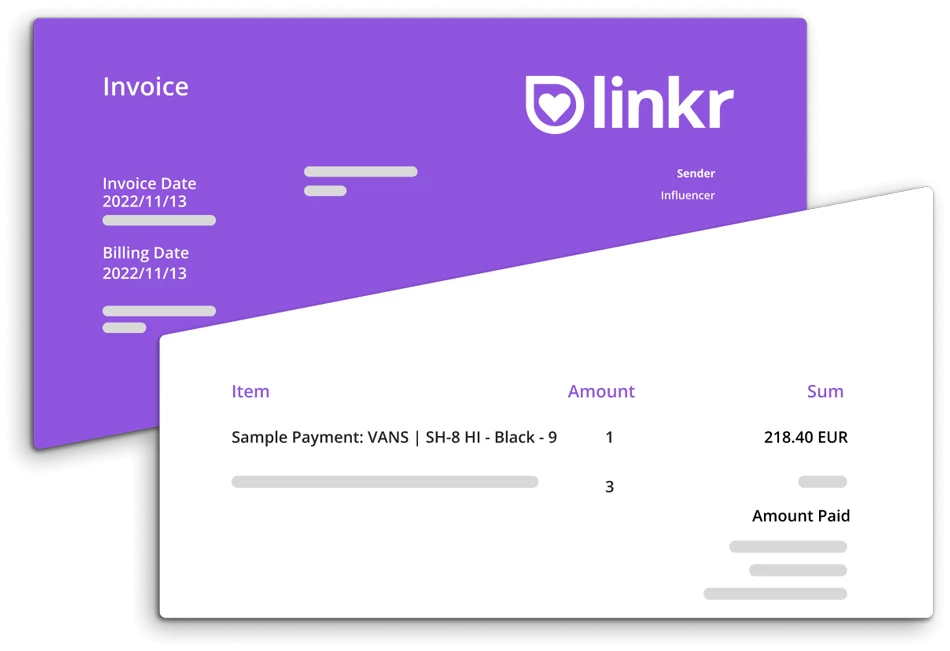

Tax-compliant samples

Let linkr create product sample invoices for influencer compensations

With linkr's payment and invoicing feature, brands can compensate influencers with free products while ensuring both parties receive the necessary tax invoice. Even though no money has exchanged hands, influencers (in most countries) are required to pay tax on the monetary value of the products they receive.

linkr's platform generates product sample invoices for brands and influencers, making it easy for both parties to stay compliant with tax regulations. Say goodbye to the hassle of figuring out how to invoice for free products.

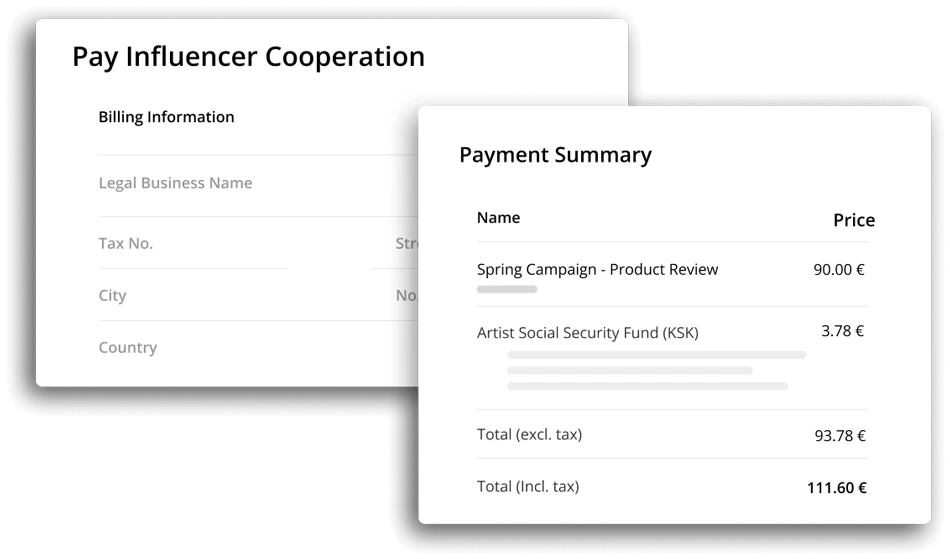

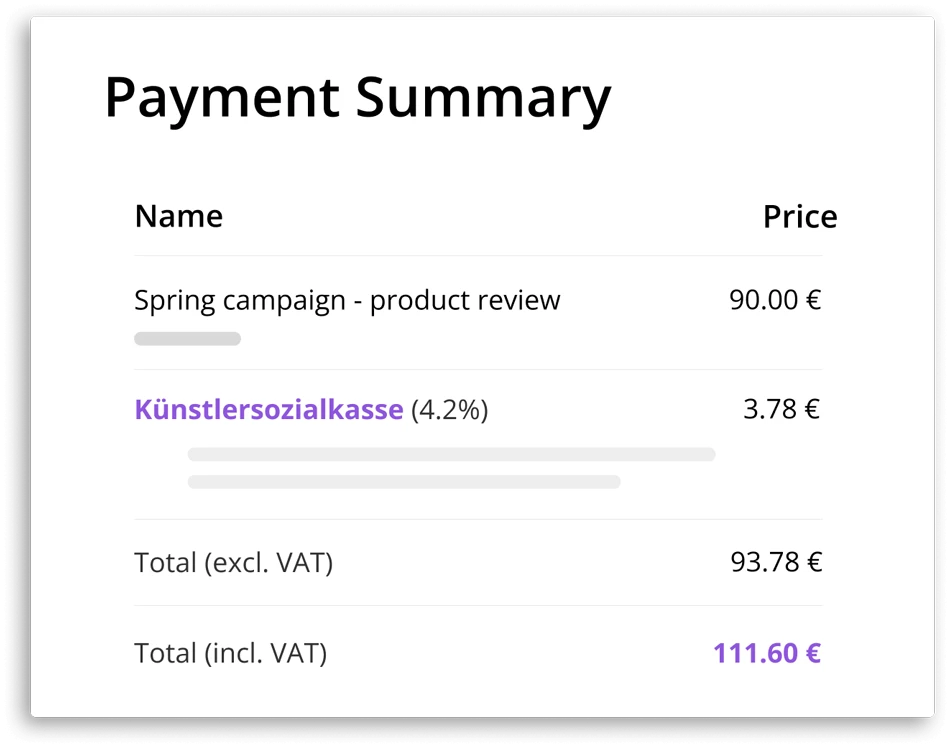

Compliant payments

Stay compliant with local regulations

With linkr, paying influencers is not just simple, but also compliant with local regulations. In countries like Germany, where businesses must pay the so-called "KSK - Künstlersozialkasse" (translates: artist social security) fee, which collects 4.2% of each payout , linkr takes care of everything.

The platform automatically collects the required fees, including the 4.2% KSK fee, with every payment, saving small businesses the headache of unexpected expenses and complicated calculations. Trust linkr to handle your influencer payments, so you can focus on growing your business.

Did not find what you were looking for?

Check out some of the most frequently asked questions related to identifying and managing Influencers on the linkr platform below or visit our

At linkr, transparency and clear communication are key. Our payment and invoicing system reflects this, with all payment terms agreed upon before a campaign begins. These agreements are recorded and shared with both parties, helping to avoid disputes. In the event of non-delivery, brands have the ability to withhold payouts, protecting their interests.

For resolving any discrepancies, both brands and influencers can directly communicate via the platform's integrated chat system. If further assistance is needed, our dedicated customer service team is on hand to mediate and help reach a fair resolution.

linkr's invoicing process is designed with flexibility to adapt to the specific tax regulations and requirements of different countries. Our system generates product sample invoices that comply with local tax laws and can be customized based on the brand's location or the influencer's residency. We also manage influencer compensation with attention to taxation requirements in different regions.

However, we advise all users to consult their local tax advisor to ensure compliance with their specific circumstances as linkr provides a tool to assist with these processes, but does not offer tax advice.